In the aftermath of the COVID-19 pandemic and Russia’s invasion of Ukraine, the world is facing a historic energy crisis and peak crude oil prices.

Fuel prices in North America and South Asia have risen sharply, while energy costs in Europe remain incredibly expensive.

The Biden administration pleaded with Saudi Arabia to increase oil output. Riyadh reluctantly agreed in early June, announcing that output would be increased in July and August.

What’s affecting crude oil prices?

Demand: Amidst rising crude oil prices, consumption of oil products does not appear to be declining. Major economies are also seeing increased demand. The Chinese economy is reviving after several weeks of COVID-19 lockdowns in critical cities such as Shanghai.

Gas consumption in the European Union remains below pre-COVID-19 levels and is likely to remain so due to the collective’s attempts to reduce all Russian oil imports. Nonetheless, demand remains strong globally, and it is expected to rise further in the coming months, particularly in China.

Supply: In a typical scenario, oil producers would increase oil output in response to rising demand. The global oil sector does, however, still have a startlingly low amount of spare capacity. The biggest oil-producing country in the world, the United States, will raise output in 2022 by up to 720,000 barrels per day.

Currently, less than 2 million bpd of spare capacity is held by OPEC, which is led by Saudi Arabia. Due to the current struggles many member nations are finding it difficult in meeting quotas. Experts do not anticipate OPEC to reach the level of production it has declared for July and August, which is an increase of almost 600,000 bpd.

Dearth in Refining Capacity: It takes time for a refinery to produce refinery products; each refinery is designed to produce specific products in specific quantities. Refinery throughput changes are costly and time-consuming. As a result of the COVID-19 pandemic, global refining capacity decreased, with multiple refineries in North America and Europe closing.

Prior to COVID-19, the industry was facing “peak oil demand,” which was attributed to slowing economic growth, rising electric vehicle adoption, and an overall push toward net-zero greenhouse gas emission commitments. Many companies have not committed capex in building new refineries in view of the risk of future demand declines. As a result of the current consumption boom, product demand is outpacing refining capacity.

Strategic Reserves: Although countries and businesses can draw from strategic oil reserves kept for future use—a development of the 1970s energy crisis that continues to influence energy economics today—those reserves are being depleted at an unusually rapid rate.

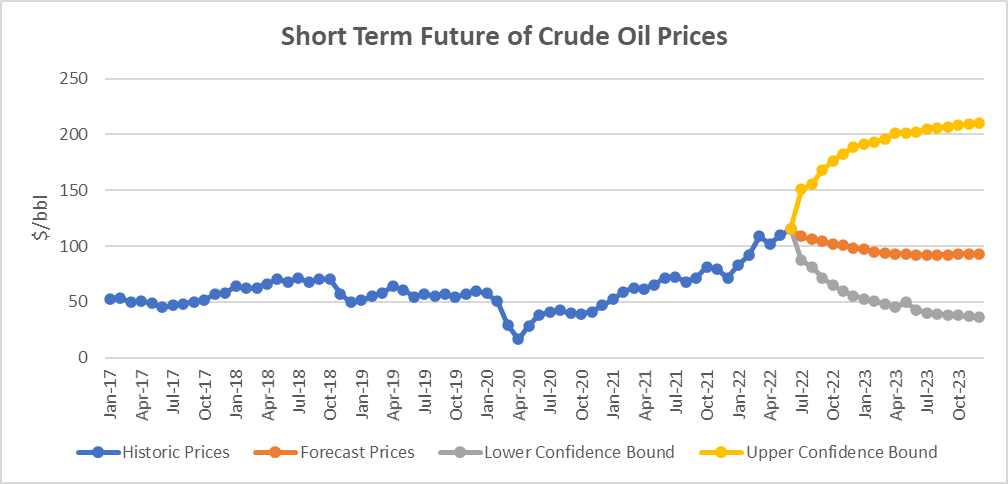

Short Term Future of Crude Oil Prices

As per EIA, the Brent crude oil spot price averaged $115 per barrel (bbl) in June. It expects the Brent price will average $108/bbl in the second half of 2022 (2H22) and then fall to $97/bbl in 2023. Current oil inventory levels are low, which amplifies the potential for oil price volatility. Actual price outcomes will largely depend on the degree to which existing sanctions imposed on Russia, any potential future sanctions, and independent corporate actions affect Russia’s oil production or the sale of Russia’s oil in the global market.